Example Of Euro Commercial Paper

Corporation issues a short term bond denominated in british pounds to finance its inventory through the international money market it has issued eurocommercial paper.

Example of euro commercial paper. Euro commercial paper ecp commercial paper issued in a eurocurrency the market for which is centred in london. Loan in the form of short term paper issued by companies. Usually redeemable at par value and pays no interest.

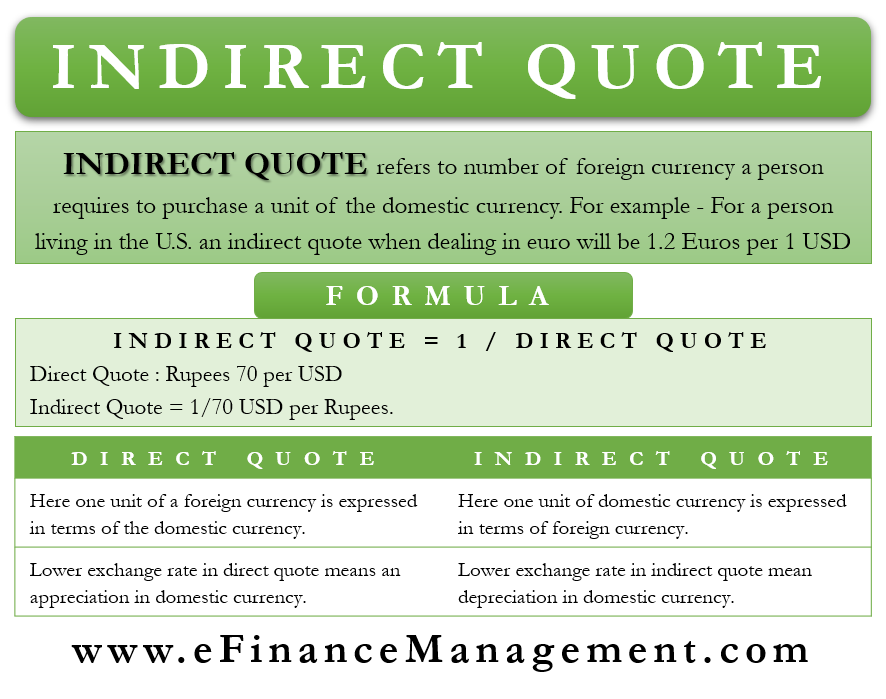

Because of its longer maturity ecp is traded more often in the secondary market than us commercial paper uscp. The ecp works to be an attractive short term financing tool for firms that wish to reduce forex market risk. Euro commercial paper ecp is an unsecured short term debt instrument that is denominated in a currency differing from the domestic currency of the market where it is issued.

Euro commercial paper is a short term unsecured unsubordinated bearer promissory note issued in eurocurrency in interest bearing form and quoted on an add on basis commonly with maturities of 30 60 90 and 180 days up to one year paralleling maturities of interbank deposits.