Example Of Asset Backed Commercial Paper

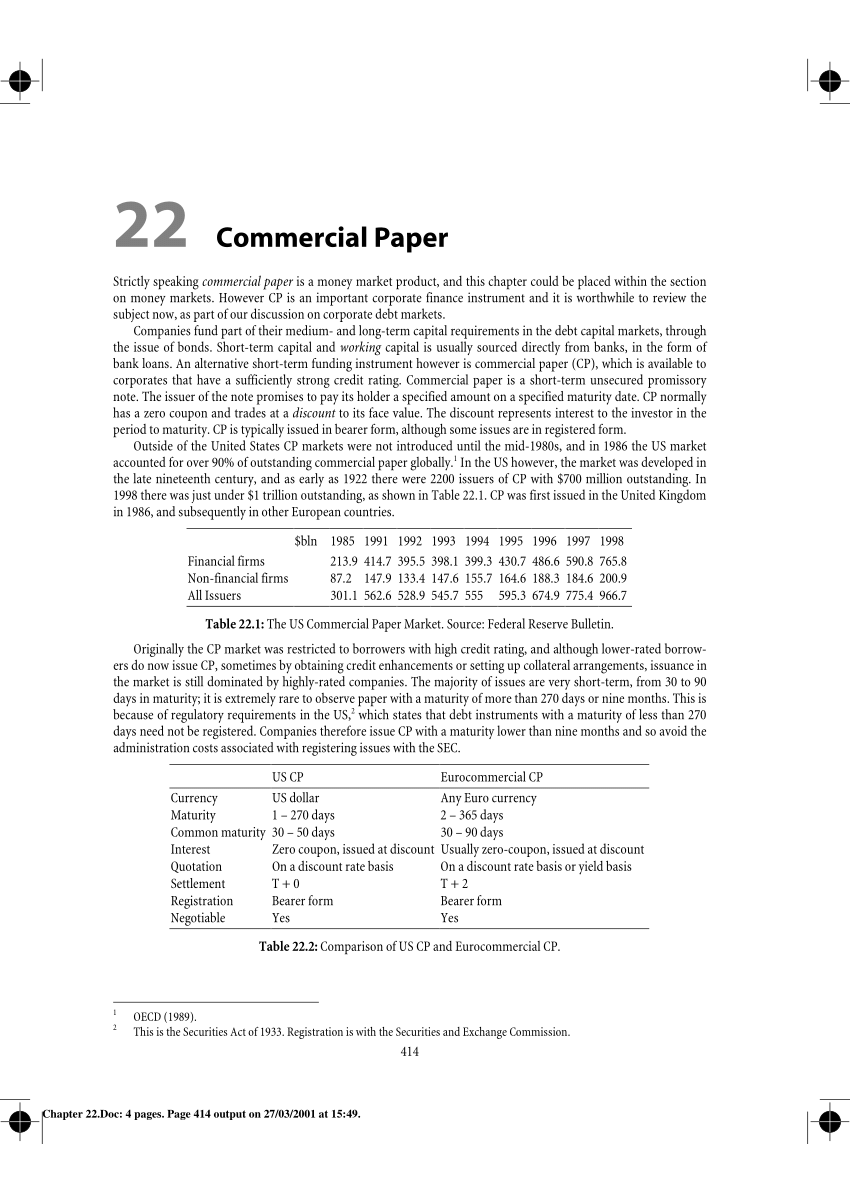

An asset backed commercial paper abcp is a type of short term investment with a maturity date of no more than 270 days.

Example of asset backed commercial paper. An asset backed commercial paper is a type of collateralized debt obligation that is sold on the secondary market. Abcps are short term secu rities with more than half having maturities of 1 to 4 days. Abcps differ from conventional commercial paper in that it is backed.

It is usually unsecured but at times backed by financial assets. What is stock exchange. Abcp is like traditional cp in that it is issued with maturities of one year or less typically less than 270 days and is highly rated.

Created in the mid 1980s asset backed commercial paper abcp trailed its term asset backed securities abs cousin in acceptance by fixed income investors especially corporate cash managers. What is asset backed commercial paper. Unsecured commercial papers these are traditional papers and allotted without any security.

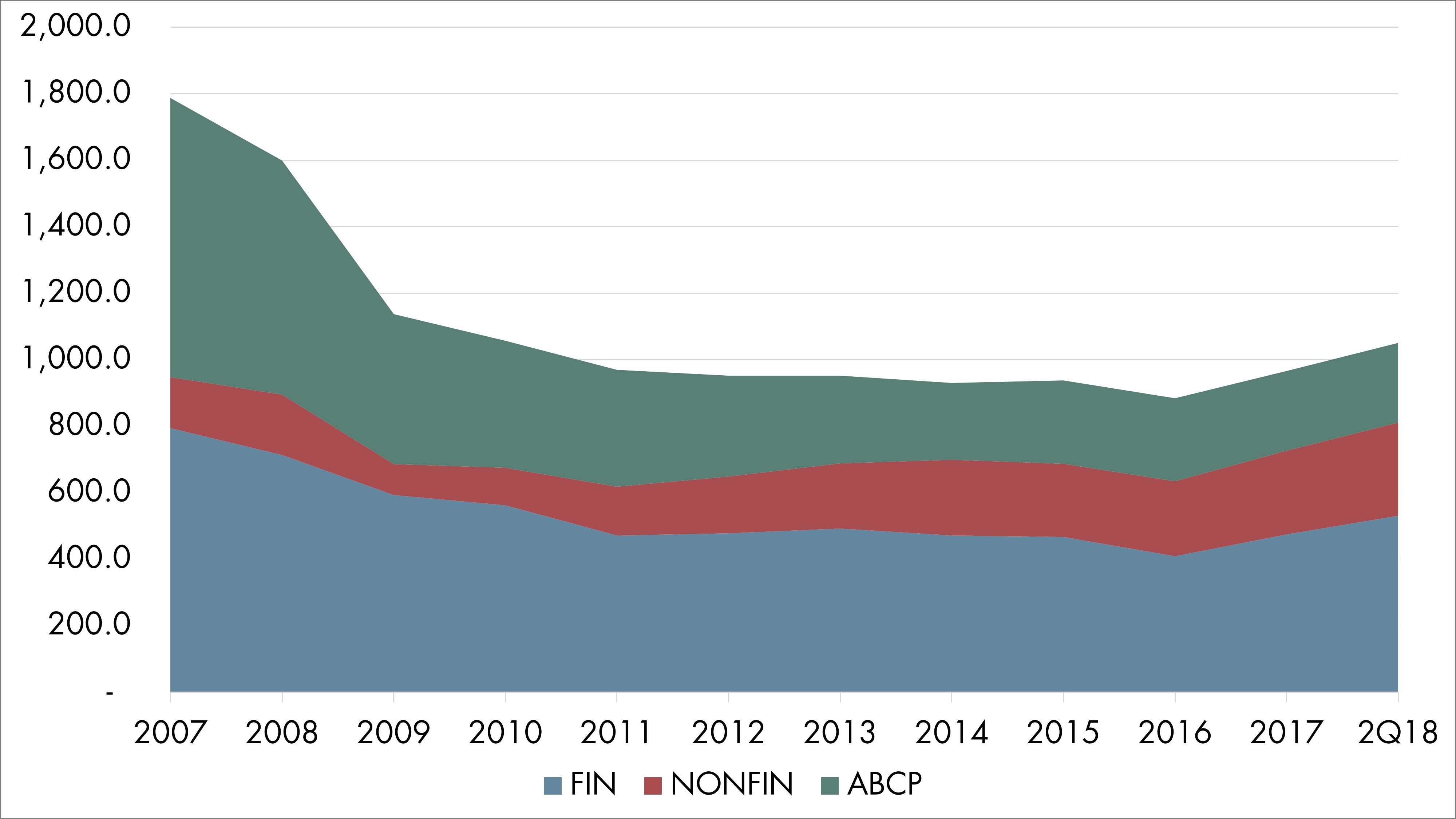

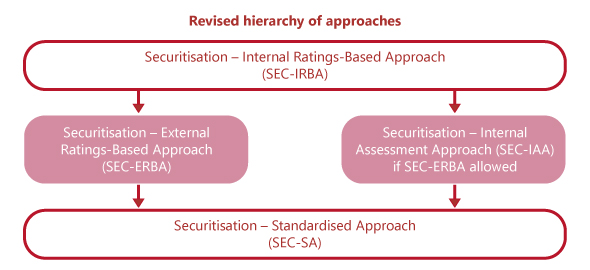

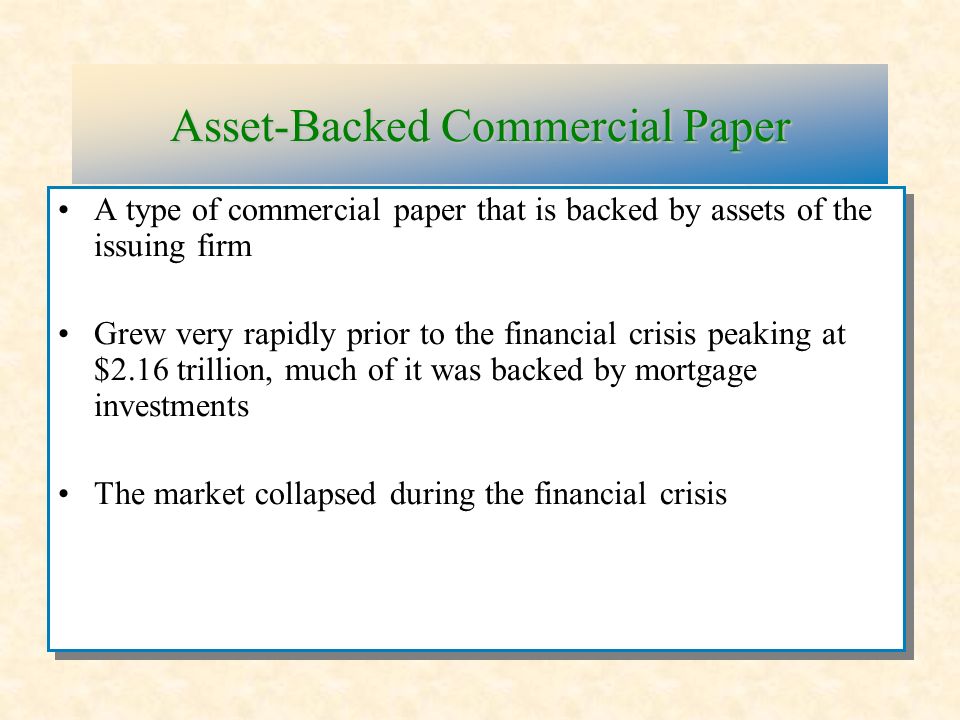

An asset backed commercial paper is typically issued by a non bank financial institute such as a conduit or special purpose vehicle spv special purpose vehicle spv a special purpose vehicle entity spv spe is a separate entity created for a specific and narrow objective and that is held off balance sheet. The role of asset backed commercial paper in the financial crisis a special type of commercial paper known as asset backed commercial paper abcp played a role in the subprime mortgage crisis in 2008. Abcp issue may be backed by several distinct asset classes from a variety of sellers.

Secured commercial papers it is also known as asset backed commercial papers abcp and assured by other financial assets. Structure of an asset backed commercial paper. The commercial paper market is growing and most of the investments are through prime money market funds mmf.

This compares to standard commercial paper cp issued by a bank or other corporate entity in which the investor is exposed to the risk of a downgrade of the issuer s debt or to an outright default by asset backed commercial paper. A bank financial institution or large corporation typically issues abcps. The company selling the abcp must set up a special purpose vehicle spv which owns the asset.